Whether you have a lot or a little, everyone needs to manage their money. Like so many areas of life, you can do things entirely by hand, or you can turn to software to make your life easier. There's a wealth – if you'll pardon the pun – of personal finance tools out there, but many of them involve having to put your hand into your pocket, dig deep and part with some hard-earned cash.

- Acemoney Personal Finance Software Reviews

- Best Personal Finance Software

- Acemoney Personal Finance Software Download

You could, of course, pay an accountant to take care of your money for you, but this involves and outlay that you might well prefer to avoid. Take a look through the selection of free tools we've collected together, and you should find something that suits your personal finance needs, making it easier to keep track of your money. This free personal finance software could hopefully save you some money too or, at the very least, see where you're currently spending it.

Acemoney Personal Finance Software Reviews

AceMoney is created by MechCAD Software, one of the leaders in specialist personal finance software and engineering software products. AceMoney is available at a one-off download fee of $39.99, one of the cheapest products on offer. It is suitable for Windows and Mac, and there is a 30-day free trial so you can try it out before you commit. AceMoney Lite is the best free alternative to Quicken or Microsoft Money personal finance software Many people used Microsoft Money or Quicken for a long time, but switched to AM, personal finance software, after trying and liking the simplicity and ease of use. People all over the world use AceMoney Lite for their home budget needs as the best free Quicken alternative for their personal needs. AceMoney version 4.37.1 / December 24, 2018 Personal Finance Software for Mac OS X or Windows. AceMoney is the best Quicken or Microsoft Money alternative financial software you can find, for Mac OS X or Windows. Manage accounts of different types in different currencies, track your spending habits, record your expenses, or do on-line banking. From MechCAD Software: AceMoney helps people organize and manage their personal finances quickly and easily.

1. GnuCash

Flexible enough for home users and small businesses

GnuCash is simple enough to be used for home finances, but flexible enough to be put to use by small businesses as well. While the software is easy to use, the fact that it's suitable for small business accounting is thanks to the inclusion of a number of extra features that you would not necessarily expect to find – support for payroll management and double-entry accounting, for instance.

Although relatively easy to use, this free personal finance software does really require some familiarity with accounting software, and it's simple to migrate from another program because you can import data in QIF and dOFX formats. Support for expense tracking makes this ideal software for preparing for tax season, and there are a huge number of reporting options to help you to make sense of your cashflow. The software is available for macOS, Windows and Linux, as well as Android, and it's highly recommended that you try out this great tool before you consider any of the paid-for alternatives.

2. Buddi

Clear and well designed – ideal if you're new to finance software

Proving that free personal finance software doesn’t have to be complicated, Buddi keeps things about as simple as they can be. In a matter of minutes, you can set up all of the accounts you need and start keeping track of your incomings and outgoings.

Money can be easily pulled from and moved between different accounts, and Buddi can generate all sort of reports about your spending and earnings broken down in a variety of ways. If you're looking to save money, the program can help you to stick to a budget and for anyone who is completely new to the concept of accounting, the Buddi website has a number of helpful guides to help get you started.

On the downside, Buddi requires you to have Java installed which is not going to be to everyone's liking, and the software itself has not been updated for a little while. Neither of these two factors are enough to stop us from recommending that you take a look at the program – it could well be just what you've been looking for.

3. AceMoney Lite

A great choice if your financial affairs are relatively straightforward

Billing itself as an alternative to Quicken sets a high bar for AceMoney, but it's a target it manages to reach, even in its free, cut-down iteration. There's only support for two accounts in AceMoney Lite, but this should be enough for many people – and the full edition of the program is only $40 (around £30, AU$50) anyway. You can even use the program to keep track of your PayPal account.

Managing accounts in different currencies is no problem, but you'll have to enter data into this free personal finance software rather than having your transactions pulled in from your bank account. That said, if you download statements from your online bank account, these can then be imported to saved time with manual entry. AceMoney Lite also makes it easy to track your spending and investments, making it a great financial tool for anyone looking to take control of their finances.

4. HomeBank

Powerful finance software with handy reports to keep you on track

HomeBank will appeal if you work on multiple platforms, or don't use Windows by default. Available for Windows, macOS and Linux (there's also an Android app in development) HomeBank can be installed normally or as a portable app, and it makes the topic of personal finance easily accessible. If you've been using another program – such as Quicken or Microsoft Money – to manage your finances, you can import data to save having to start from scratch.

You can add an unlimited number of accounts to the program, and they can be linked to each other to allow for easy money transfers – it is all entirely dependent on manual editing, though. With enough data entered, it's possible to generate all manner of reports, including helpful predictive reports for car ownership and the like. Very much designed with the average person in mind, this is a personal finance app for people who hate personal finance apps.

5. Buxfer

An online-only tool that imports data directly from your bank

Best Personal Finance Software

Buxfer is an online tool that makes it easy to manage all of your accounts in one place – although there is also an Android app available. There's support for over 15,000 online bank accounts from all over the world, so you should find that yours is there, and then you can pull in all of your transactions without the need for manual entry.

Buxfer can also pull in data in from the likes of Quicken and Mint, help you manage budgets and forecast costs and earnings, and track investments with ease. You will have to spend time categorizing transactions manually if you upload them from your statements, but this isn't too much of a chore. You can set up alerts, track bills, and predict spending patterns; it's a highly versatile tool.

There is a free version of service available, but there are also three paid-for tiers ranging in price from $1.99 to $4.99 per month. It's worth taking the free version for a spin to see if it could do the job for you – this will let you work with up to five accounts, which is likely to be enough for most people.

- Save even more money with our pick of the best free office software

Editor's Note: This review has been removed from our side-by-side comparison because it no longer ranks as a top 10 product. The original review is below, but check out our current Personal Finance Drive here.

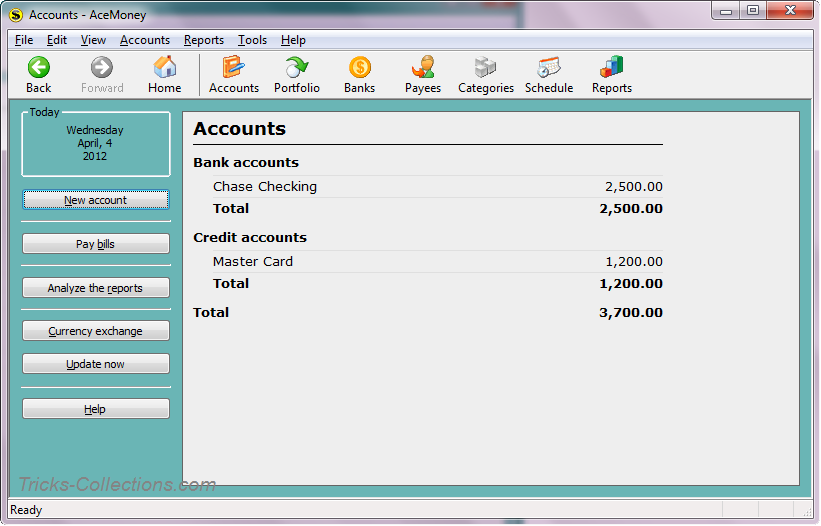

AceMoney is a simple software that offers good transaction tracking options to manage your home finances. While it is not a newer, online service and does not include some of the budgeting features of other personal finance software, if you need to keep track of a lot of transactions, payees and categories, AceMoney can help you stay organized.

When adding accounts to AceMoney, you can sync directly to your financial institutions, uploading transactions from your bank, credit union, credit card provider and brokerage account. You can also upload files you download from your bank if you choose not to sync your accounts. This may be less convenient because it does not automatically update, but it is a choice if you are concerned about security. This software does use a secure SSL transfer, the same security that your bank uses for other transfers. One downside to the service is that it does not offer mobile apps, so you cannot upload or edit transactions as you're out spending money. However, if you sync your account, they upload automatically.

Adding transactions manually is easy to complete, and the system remembers payees, transactions, amounts and categories to make frequently used transactions quicker to add and organize. This personal financial software is a great choice for organization in general. Sudden attack 2 download pc. You can edit payees and include addresses, a phone number and comments.

Creating and editing your budget is fairly simple, though different from other budgeting services in that you set a budget in a single page. With this budgeting software, you manage each individual category, selecting a limit amount. You must do this for each, opening and managing each individual category. This way of setting up a budget is less convenient that other services' budgeting feature where you can simply click once and edit the limit. But it's not necessarily difficult or unintuitive. It does not offer certain budgeting functions, such as rolling over the balance from the previous month or setting alerts for going over budget.

With the exception of tax reports, AceMoney has the most popular reporting choices, including net worth, spending and cash flow reports. You can choose the parameters that you wish to view on specific reports, including dates, categories payees and accounts, and you can view the information in a data table, period chart or total bar chart. You can also run reports for your personal investments.

Acemoney Personal Finance Software Download

In the personal investing section of the software, you can keep track of your portfolio and add new transactions, including syncing to your brokerage accounts. Beyond the above-mentioned investment reports, you can view information about your security allocation by symbol, broker and investment vehicle. It does not offer more advanced investment features, such as comparing your portfolio to the market or tracking commission and other fees.

AceMoney is a good personal accounting software with many positive features, but it also dated and missing some features of newer software. This desktop software syncs to your financial institution and brokerage accounts, but it does not offer mobile apps to manage your budget away from your desktop. It allows you to manage your transaction and keep track of your account balances, but it is less useful as a budgeting program, including not having a way to track remaining allocated budgets or set alerts when you exceed budget limits. What AceMoney does, it does well, particularly organizing large amounts of data, but it also lacks convenience features that other home finance software offer.